BTID (Buy Term and Invest the Difference) or VUL (Variable Universal Life)? Which one is better for me? This is one of the most common debates that we have when it comes to personal finance. The answer is simple: it depends! It will depend on you as there’s no one-size-fits-all when it comes to insurance, let me explain.

Life insurance, in a nutshell, is all about having peace of mind even if SAD (sickness, accident, death), unpredictable events happen in life. It’s an income protection fund that will make sure that our savings and future will not be compromised when the time comes.

VUL on the other hand combines the best of both worlds as it has both insurance and investment components. If something happens to the life-insured breadwinner, the family or beneficiaries will get a lump sum amount to supply for their needs. If the insured is healthy, the investment component of the plan will grow based on the chosen fund allocation of the client. But the returns are never guaranteed as the value can go up and down, that’s why it’s called “Variable” Universal Life.

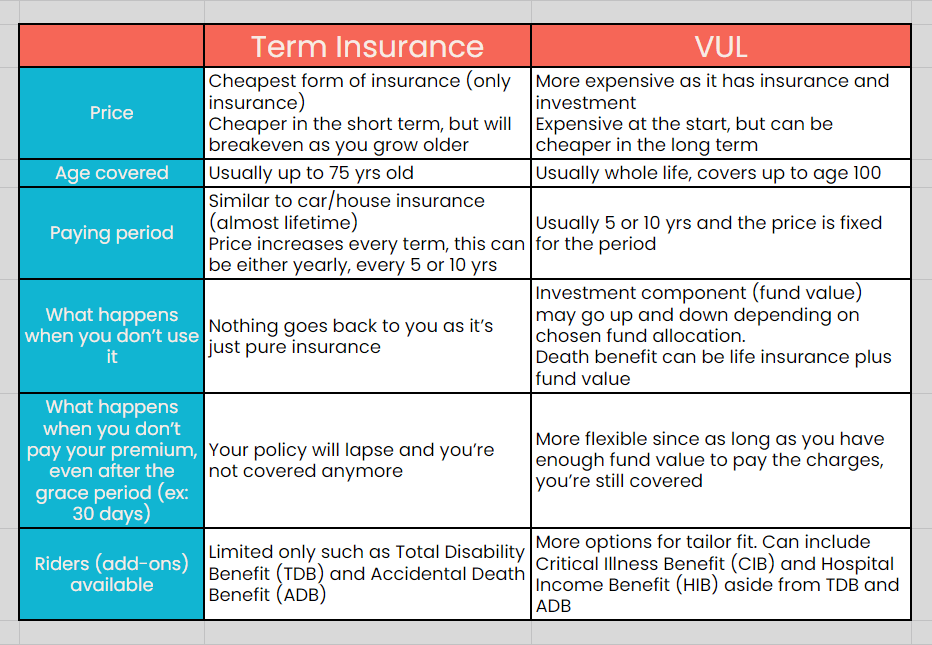

Term Insurance vs VUL

BTID is a strategy, that instead of buying a 2-in-1 VUL product, buys a term insurance and just invests the difference on their own on different investment vehicles such as stocks, bonds, etc. This means that you’re separating your insurance with your investments.

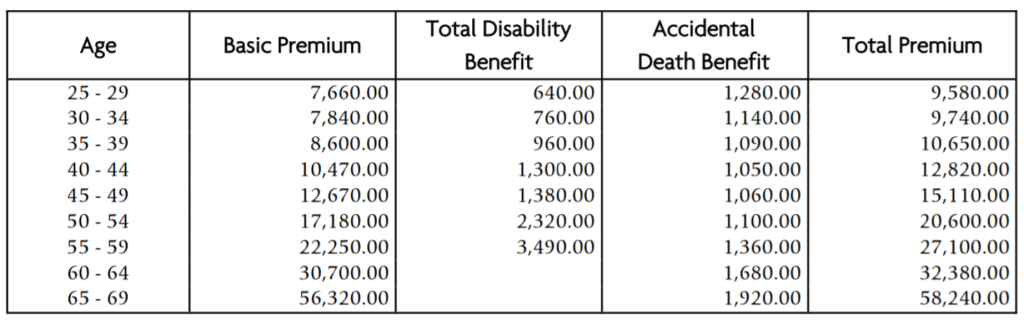

Age, gender and smoking habits affect the premium for insurance

The 1M coverage will be given whichever comes first, death or critical illness

Riders are optional for additional benefits: ADB means there’s additional coverage if the cause of death is accident

TDB waives the premium if in case of total disability

For example, instead of buying ₱1,000,000 coverage worth ₱30,000 for VUL. You’ll buy a term insurance worth approximately the same ₱1,000,000 for ₱10,000, then you’ll invest the difference of ₱20,000 on your own.

So when is VUL better for you?

- Perfect for beginners, who are just starting and don’t know where to invest

- Know the risk and treat VUL as an insurance product, where the main focus is still income protection, and the investment component is just a bonus

- Long term horizon as charges for the first few years are quite big, which means only a small portion is invested

- Quite busy and will focus more on other things in life instead of focusing on investments

So when is BTID better for you?

- If you’re knowledgeable with various investment instruments with their pros and cons. You’ll DIY invest the difference

- Perfect for first insurance and you’re on a tight budget

- Disciplined enough to invest and monitor their investments on their own, instead of doing BTSD (Buy Term, Spend the Difference)

There is a common misconception that the majority of financial advisors favor offering VUL compared to term insurance as it gives higher commission. This is somewhat true for “agents” whose main goal is to squeeze as much money from their clients without doing financial needs analysis (FNA), wherein the financial advisor should ask the client the right questions, e.g. What’s the main purpose of them availing of life insurance?

As a financial advisor, it’s my job to explain the pros and cons of BTID and VUL. Then I’ll let the client decide on what suits them better for their goal and budget.

What’s great is that you don’t need to choose either VUL or BTID, you can do both. I started availing of VUL before I became an FA and I just bought a term insurance for myself this month as it’s the cheapest form of insurance for additional health coverage to cover critical illness.

Frequently Asked Questions

What if I already have a VUL and I also want to do BTID, should I cancel and avail of term insurance?

- You should revisit the main purpose of availing of VUL in the first place, is it for protection or is it for investment? If it’s for protection, you can just keep it. If you think the premium is higher than expected, you can ask your FA to lower the coverage so that it would be cheaper. The worst case scenario is if you give up your VUL and you don’t avail of another insurance. This would mean that you lost some money and you’re not covered anymore, so you’re back to square one.

Where can I invest on my own?

- You can check my blogs on MP2, GInvest, GoTrade, Stock Market to have an idea which investment vehicle is the best for you.

Are there other ways of insurance aside from term insurance and VUL?

- Yes, the most common one is a whole life (up to age 100) insurance that focuses more on health, which covers critical illness aside from life insurance. This is better than term insurance as it covers more critical illness and it’s only a limited paying period. Health insurance is recommended as based on probability, you’ll get sick first before you die, especially with this pandemic.

Final Thoughts

Next time you encounter a financial advisor, you can bring up this comparison of BTID and VUL, so you’ll know their stand on it. Remember that when availing of insurance, the most important factor to consider aside from the product and the company, is the financial advisor as being an FA is a lifetime commitment. The main service of financial advisors is during the claiming process of either death or sickness. What usually happens for some insurance advisors is that they just sell you the product and couldn’t care less about you afterwards.

If you have any questions, feel free to comment or reach out to me so I can answer all your inquiries, including a policy review of your plans so we can check if they’re still aligned to your goals. As a Sun Life financial advisor, if you or somebody you know is a Sun Life policy holder and is not satisfied with their service of their FA, you can just let me know so I can transfer their plan to me so I can serve them well. Note that transferring/changing of financial advisors will mean that the old and new FA will not receive commissions anymore, so it’s just really for service. I’ve already had almost 10 clients who transferred to me.

Do join the Financial Literacy PH FB group that I created for additional learnings.

Remember that when it comes to insurance, it is better to have and not need it, than to need and not have it. So next time, don’t just shut down financial advisors approaching you as they just want to help you prepare for your future.