If you’ve been reading my other blogs, you’d know that one of the reasons we invest is to get passive income because we cannot work forever. Even if we want to work all day, we’re limited to 24 hours in a day and 7 days in a week.

That’s where passive income a.k.a. investments come in, where money makes more money. To be able to retire comfortably in the future, one thing we need is to have our passive income be greater than or equal to our monthly expenses.

For example, let’s say your monthly expenses is ₱20,000 and your passive income monthly from your investments is ₱25,000. That means, even if you don’t work anymore, you’ll still be able to live fine and pay all the bills.

What I just mentioned is what we call financial freedom, where we have the choice on whether we want to work or not. If we’re going to work, it’s because we want to, not because we need to. I’ll be making a blog regarding FIRE (Financial Independence, Retire Early) in the future.

You’re probably thinking about how you can make ₱20,000 pesos or whatever amount you need in a month? This is what the blog is all about, ALFM Global Multi-Asset Income Fund is one of the investments that will help you reach that goal!

ALFM Global Multi-Asset Income Fund

For the purpose and simplicity of this blog, I’ll be calling ALFM Global Multi-Asset Income Fund as ALFM GMAIF moving forward.

I’ve already discussed Mutual Funds (MF) and Unit Investment Trust Fund (UITF) before in my GInvest blog where you choose a specific fund based on your risk appetite and goals and it ends up being already diversified compared to individual stock picking.

ALFM GMAIF is a USD denominated fund operating as a Feeder Fund that aims to provide a stable stream of dividends and generate long-term capital growth. It’s also being managed by BlackRock, the top 1 fund manager in the world. Being a feeder fund, it will invest at least 90% of its assets into a single collective scheme. The Fund invests globally in the full spectrum of permitted investments including equities, equity-related securities, and fixed income transferable securities.

What makes ALFM GMAIF different? Usually dividends for MF/UITF are reinvested back to the fund so you’ll get more units/shares. But with ALFM GMAIF, it’s the only MF/UITF in the Philippines that gives out dividends straight to the investor.

This isn’t just any dividend, it’s monthly dividends (credited on 15th of the month) and also, it’s tax-free! Usually the dividends that we receive have tax, 10% for PH stocks while 25% for US stocks such as through GoTrade.

As you can see in the table above, its annual yield is 5+% which is similar to digital banks such as GSave, Tonik, etc, wherein you get a fixed monthly interest (up to 5+% per year depending on promos).

What makes ALFM GMAIF one of my favorite investments is that it offers the best of both worlds: capital appreciation (increase in stock price) and dividends.

What’s great is that we Filipinos can invest using Philippine Pesos (PHP), reducing the Forex (Foreign Exchange) risk since there’s no Peso to Dollar conversion. You can check out the fund fact sheet here.

For the computation of dividends, it’s the number of units x unit dividend x NAVpU (Net Asset Value per Unit). Since unit dividend and NAVpU is given/fixed based on that day, which we can get through the ALFM website, we would just need to get the number of units.

To compute for the number of units, it’s invested amount divided by NAVpU

In my example, my investment is around ₱209,000 so it’s 209,000/43.9564= 4754.71 units

So to compute the dividend amount, it will be 4754.71 x 0.0048 (table above) x 43.9564 (email above) = ~₱1003.2 which is correct.

To compute for the invested amount, it’s dividend amount divided by unit dividend

So in my case it’s 1004.43/0.0048= ₱209,000.

How to Start?

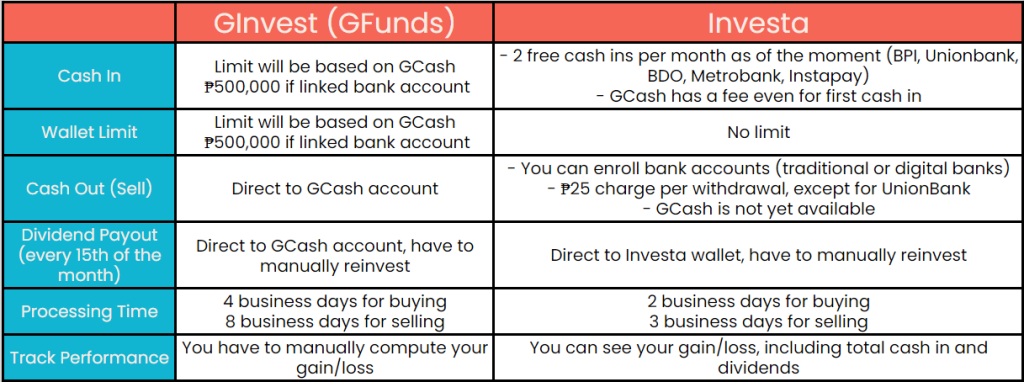

There are different ways on how you can invest in ALFM GMAIF. But the most convenient is through GInvest (now called GFunds) since you can invest directly using the GCash app. You’ll need just at least ₱1000 before you can start.

Another way is through Investa. What I like about Investa is that I can see the actual gain/loss, so there’s no need to compute on my own. There’s also total dividends, which is a great measure to know my recurring cash flow.

I even reached out to the co-founder of Investa, Airwyn Tin! I met him virtually since he joined FinLit and he’s very approachable and very open to feedback. I will write a separate blog on Investa in the future for a deep dive on the app.

Difference of ALFM GMAIF using GInvest vs Investa

As you can see, the main advantage of using GInvest to invest in ALFM GMAIF is really the convenience since everything is in the GCash app, but since GCash is just a middleman, there will be longer processing time for buying and selling. Lastly, you have to manually compute your gain/loss which can be inconvenient.

With that, I’m planning to transfer my ALFM GMAIF in GInvest to Investa through batches as there’s only 1 free ₱50,000/cash-in through Instapay per month so it would be easier to track the performance.

How much and When should I invest?

As long as you have the extra money that you’re willing to risk, you can put it in ALFM GMAIF, just take note of the waiting period for buying/redemption.

For me, the best time to invest in ALFM GMAIF is when you receive the dividends, usually the 15th of the month so you can reinvest it. For example you get ₱100 as dividend, instead of using that money, you should reinvest the ₱100 along with adding more capital like a fixed amount such as ₱5000 for example.

You’ll invest ₱5100 back to ALFM GMAIF to get more dividends next month since it’s compounding and just repeat this process every month. This is what we call dividend investing. This is what I’m doing personally for ALFM GMAIF.

Final Thoughts

ALFM GMAIF may be one of the best investments for me, but I just want to reiterate that personal finance is personal. What might work for me, might not work for you and vice versa. So DYOR (Do Your Own Research) to check if it will fit you or not.

You can check out my other savings and investments under my portfolio. Feel free to reach out or comment if you have any questions/concerns.

Lastly, do join Financial Literacy PH, a Facebook group that I founded that reached 100,000 members in less than 19 months for more learnings! You can also apply for your Unionbank Rewards Platinum Visa here if you’re looking for a credit card.