With 13th month pay coming up, the burning question on almost everyone’s mind is “Where should I use my hard earned cash?” While it’s great to reward ourselves for all the hard work we put in this year, impulse buying everything we see is not a decision that will help us out in the long run. Why not take this opportunity and save up for your future?

Now, continuing on my money saving tips, this blog post will be talking about VUL (Variable Universal Life). VUL is a 2 in 1 combination of life insurance and investment, making it a win-win situation for you. If and when you’re not in this world anymore, a lump sum of money will be given to your beneficiaries. But while you’re still well and healthy, your investments will continue to accumulate, enabling you to plan for your future goals such as education and retirement.

The common misconception about VUL is that it functions as pure investment with huge returns. But in fact, VUL is primarily an insurance product, with the added bonus of investments. What this means is that a portion of what you’re allocating, first goes to insurance, with the rest going to investments. So VUL is perfect for people who are just starting. For the people who don’t have any insurance coverage yet and don’t know where they can save. It’s basically hitting 2 birds with 1 stone!

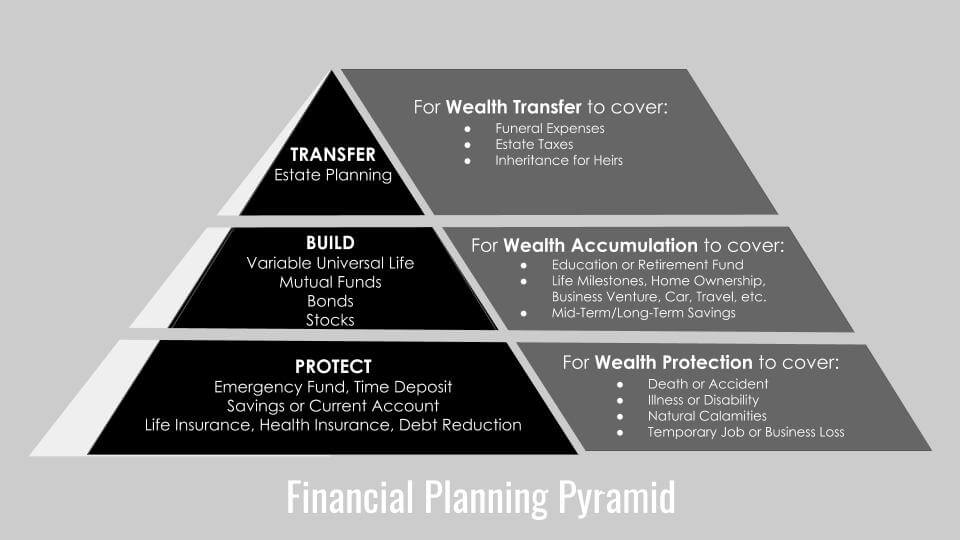

VUL functions both as wealth protection and wealth accumulation. As you can see in the pyramid below, it’s important that one must protect their wealth first. By doing so, you’ll rest assured that in case something unexpected happens, you have the wealth and resources to get through it. Only when you have protected your wealth, can you start thinking of accumulating your wealth through stocks/mutual funds, etc.

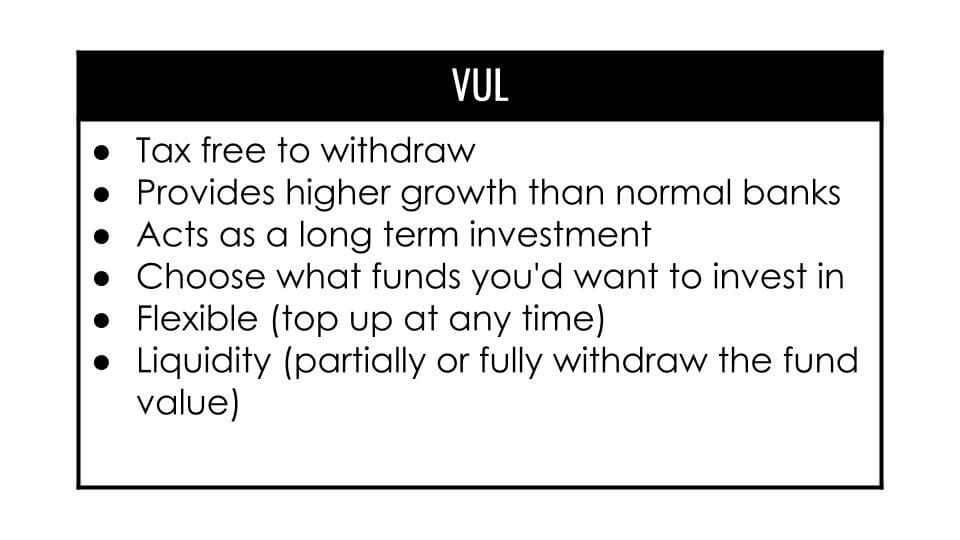

Now, why should you save in VUL over banks and the like?

First of all, it’s tax free to withdraw and provides higher growth than normal banks.

Next, it acts as a long term investment. You yourself will be choosing what funds you’d want to invest in depending on your risk profile. It’s important to note that low risk investments yield low returns while high risk ones may yield high returns.

It’s also flexible. You can top up at any time, allowing your investments to grow even more.

Finally, you can partially or fully withdraw the fund value if you ever need it. But, I would highly recommend to leave it alone if you’re not in dire need of it.

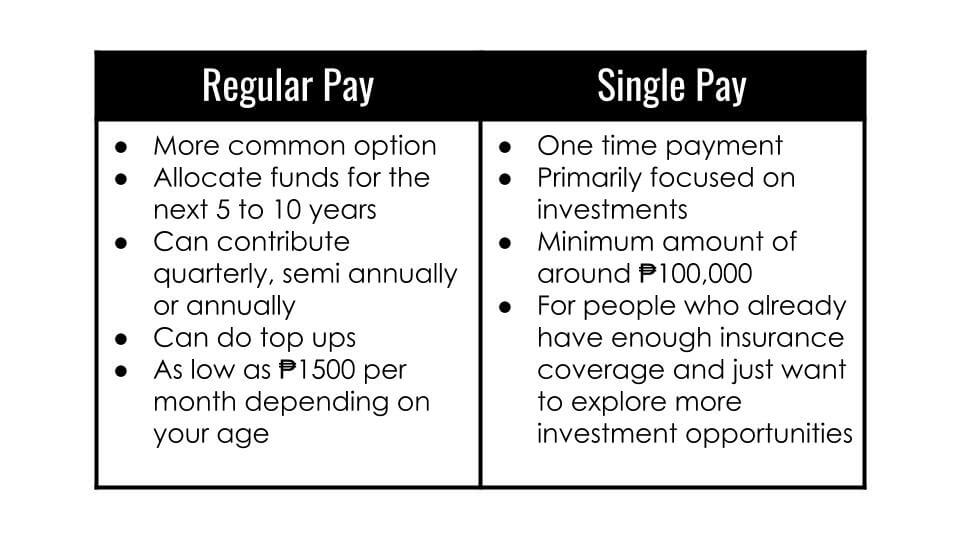

Now that you know the advantages of VUL, you’ll also need to know the 2 different types of VUL. The 2 types are regular pay and single pay.

Regular pay is the more common option where you allocate funds for the next 5 to 10 years. You can also contribute quarterly, semi annually or annually, and do top ups. It can be as low as ₱1500 per month depending on your age.

Single pay, on the other hand, is a one time payment, primarily focused on investments. There is a minimum amount of around ₱100,000 for this payment. This is perfect for people who already have enough insurance coverage and just want to explore more investment opportunities.

Investment is all about starting small and starting early. No matter how much you’re willing to invest, time is still the #1 factor on how much your investments will grow. I would advise people that are capable of doing so to better get insurance ASAP while you’re still young and it’s still cheap. It’s better to insure yourselves now while you’re still healthy and not need it immediately, than to regret not being insured at a time when you do.

If after reading this, you realized that you want to start getting a VUL now, feel free to reach out to me. Do also let me know if you have any questions regarding insurance or investments and I will try my best to help you with that. You can also join my FB group for additional learnings.

Planning for the future is not a sin, but pridefully assuming that your plans will certainly go through the way you imagined is.

James 4:13-16

Thanks for sharing these tips! 👍

Can you talk more about the single pay VUL?

MegaCool Blog indeed!… if anyone else has anything it would be much appreciated. Just wanted to say thanks and keep doing what you’re doing! Great website Enjoy!