We all know the power of digital banks and the pros and cons that come with it versus traditional banks. If you need a little refresher, feel free to check this out. But this time I’ll be sharing one of the newest digital banks in the Philippines, GoTyme!

GoTyme Bank is a joint venture of Tyme, a multi-country digital banking group, and the Gokongwei Group, which includes Robinsons Bank, Robinsons Land Corporation, and Robinsons Retail Holdings, Inc.

I’m proud to say that because of Financial Literacy PH, I’ve become one of the founding members (Gollaborators) of GoTyme. As a Gollaborator, I was able to beta test the app before it officially launched to the public. I’m also invited to their events, one of which was their launch where I met and talked to the CEO of GoTyme and Lance Gokongwei (CEO of JG Summit Holdings), along with some of my idols Thea Sy Bautista (Tita Talks), Charm De Leon (Ready2Adult), Frances Cabatuando (Home Buddies), Marvin Germo, and Randell Tiongson.

So what are the features of GoTyme and what makes it different from other digital banks?

GoSave

- 5% interest per annum, unlimited and no promos – This is my favorite feature because while other digital banks can offer higher interest rates, you can only get them through promos and there’s almost always a cap. UPDATE: Interest has been updated to 4% interest per annum starting March 1, 2024.

- You can have up to 5 GoSave accounts for different goals which can be customized. Ex: emergency fund, travel fund, education fund. You have to put your money into GoSave accounts to earn interest

- Payout of interest is monthly (first day of the month). Note that there’s a 20% withholding tax.

Debit Card

- Not all digital banks offer a physical debit card, but with GoTyme, you can get one in a matter of a few minutes.

- Just visit any of their kiosks which are usually found in your Robinsons Supermarket. The debit card is very unique as it’s oriented vertically and you don’t see any personal details in front.

- You can use this when paying in any establishment that accepts debit cards. Note that the balance used comes from your main GoTyme wallet, not your GoSave accounts.

- Tip: You can save in GoSave and just transfer your necessary funds to the main wallet so you’re still earning interest.

- You can use the same card details for online transactions and it can even be used abroad.

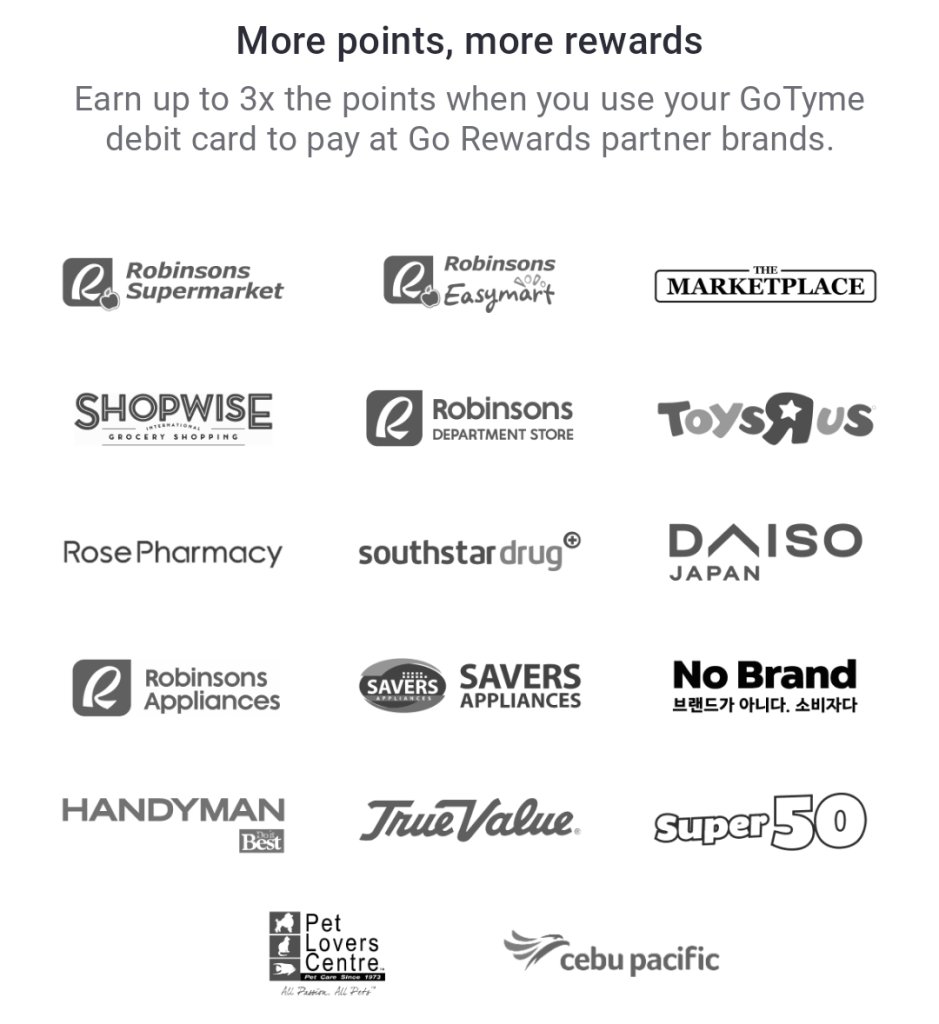

GoRewards

- In line with using GoTyme as a payment above, you get GoRewards points for every transaction. You can link your existing GoRewards account to the app, which is what I did.

- You can get up to 3x GoRewards points when you use GoTyme on their partner establishments such as Cebu Pacific, Robinsons (appliance, department store, supermarket), etc. The reflection of GoRewards points happens in real time.

- You can use GoRewards points as payment in the establishments above where 1 point = ₱1. GoRewards points can be converted into pesos as well with a conversion of 1 point = ₱0.80, so it’s better to use the former.

Other Features

- Biometrics login

- Bank Statement and Bank Certificate – you can request both directly in the app for free, you’ll receive it in your email. This can be used on your Visa application

- Pay QR – scan any QR PH code, you’ll get GoRewards points as well, 1 point for every ₱600 spent. You can use this feature when making your MP2 contributions through Virtual Pagibig. Ex: you get 5 GoRewards points if you pay ₱3000, which makes the ₱5 convenience fee free. You also have a personal Pay QR PH code where you can use to receive from other banks.

- Multi-currency Time Deposit – to be launched soon where you can get 3% interest per annum for 6 months, while 3.5% per annum for 6 months. You can start for as low as $1 and the withholding tax is 15% compared to 20% for local deposits.

- Buy load – Smart, Globe, TNT

- Pay bills – Meralco, Maynilad, Smart, Globe, RFID (AutoSweep and EasyTrip), credit cards and more in the works. Note that some billers charge fees.

- Deposit money from abroad – You can receive transfers from Wise, World Remit and RIA. This is perfect for freelancers and VAs

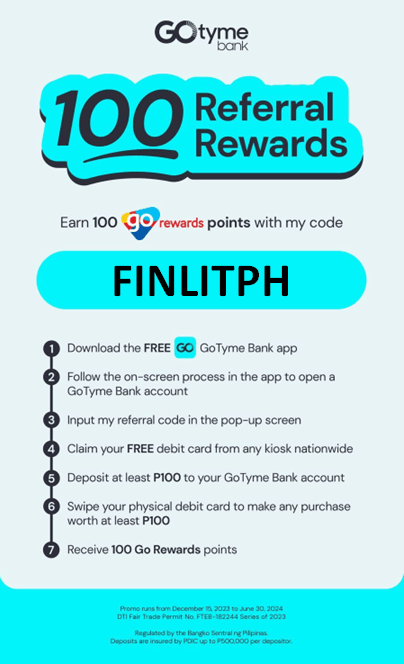

How to Get Started?

- Just download the GoTyme app in Play Store or App Store and open an account by providing your personal details, mobile number, selfie and valid government ID. It’s a straightforward process, and then you’ll provide your username and passcode.

- You can input the referral code FINLITPH then you can link your existing GoRewards account to the app and get your ATM debit card at a kiosk. Just deposit and swipe the physical debit card for at least ₱100 pesos, you’ll get 100 GoRewards points.

Cash In/Deposit

- BPI, UnionBank, Chinabank, RCBC – linked account (2 free cash ins per month)

- Partner institutions above – free cash in

- Instapay from other banks, check this for free transfers

Cash Out/Withdraw

- Unlimited transfers from GoTyme to GoTyme accounts

- GoTyme ATMs, started rolling out March 1, 2024

- 3 free transfers per week, up to ₱50,000 per transfer, cannot be increased

- Partner institutions above – free cash out

Comparing Other Digital Banks – What’s Best for Me?

GoTyme is just one of the digital banks in the Philippines. You can check out Investagrams for the comprehensive list of digital banks with their respective interest rates and caps. This list is updated frequently as well.

Currently I have the following digital banks aside from GoTyme: GSave/CIMB, Tonik, Seabank, Maya.

As I’ve mentioned before, there’s no one size fits all when it comes to any saving or investment vehicle since it’s personal. What might work for me might not work for you and vice versa. I’m using 5 different digital banks as of the moment as they each have different pros and cons.

CIMB is used mainly because of its integration to GCash and unlimited outgoing transfers. Seabank and Maya, I capitalize on their daily interest, while I primarily use Tonik for the group stash feature. Lastly, GoTyme is used for the unlimited 5% interest and GoRewards points.

I highly recommend checking out TeamZeroFees as it guides you on how to incur zero fees on cash-in and cash-out transactions! It’s also updated regularly to include any changes or new banks.

To be up to date on anything related to digital banks, join the Digital Banks PH FB group. Also, join the Financial Literacy PH FB group where I’m the founder for more money learnings. Lastly, you can apply for your Unionbank Rewards Platinum Visa here if you’re looking for a credit card.