Disclaimer: All the opinions written in this post are my personal opinions. I am not affiliated in any way with GCash nor do these opinions reflect any of GCash’s opinions.

It’s been a while since I last posted here. In the past, this blog only consisted of cellphone and general technology articles. But, as the blog’s name is XiaomiDyMoney, I thought it’d be perfect to also include financial tips to honor the “money” part of the name.

I had just recently become a financial advisor in June and with that, I want to help as many people and their families achieve their financial goals.

With the current situation of the pandemic, everyone of us is affected one way or another. But, while we are all affected, not everyone has been affected the same. I am fortunate enough to still be able to work and get fully paid while working from home. But other people aren’t so fortunate. Some have lost their jobs and some have suddenly had to step up to become breadwinners for their families. This sudden change has affected many and these people are facing this pandemic unprepared and with not enough savings to their names.

GSave

My tip for these people? Well, with payday happening around this time of the month, I’d recommend them to use GSave, the savings feature of GCash. For those that are unaware, GCash is the #1 e-wallet in the Philippines that has features like paying bills, transferring money (even to other banks) for free, paying through QR code, buying load, and even saving money. It is very easy to setup. Just download the app from the Playstore or Appstore as it is available for all networks, and you can be fully verified in a few minutes. Once you have GCash, just open “Save Money” in the dashboard to start GSave.

UPDATE: With the charges to GCash when transferring to banks, You can link your GSave to CIMB to transfer to any bank for free, but it’s not real time as it uses Pesonet, there’s a cut off time per day and if you don’t make it, it will be processed the next business day. Make sure to create GSave first then link to CIMB because you cannot create GSave anymore when you started with CIMB.

Among the numerous features of GCash, my personal favorite is GForest which helps in saving the environment. With the partnership of the BIOFIN (Biodiversity Finance Initiative Philippines), for every transaction you make in GCash, you get energy that once accumulated will be used to plant trees around the country. So, on top of the convenience and safety of online transactions, by using GCash, you can also be a part of helping the environment.

But, the main point of this article is that of GSave. What is GSave? GSave is the first ever bank account that you can open and maintain straight from the GCash app.

Benefits of using GSave

You must be asking, why would I save my money in GSave when I can just put my money in a savings account in the bank?

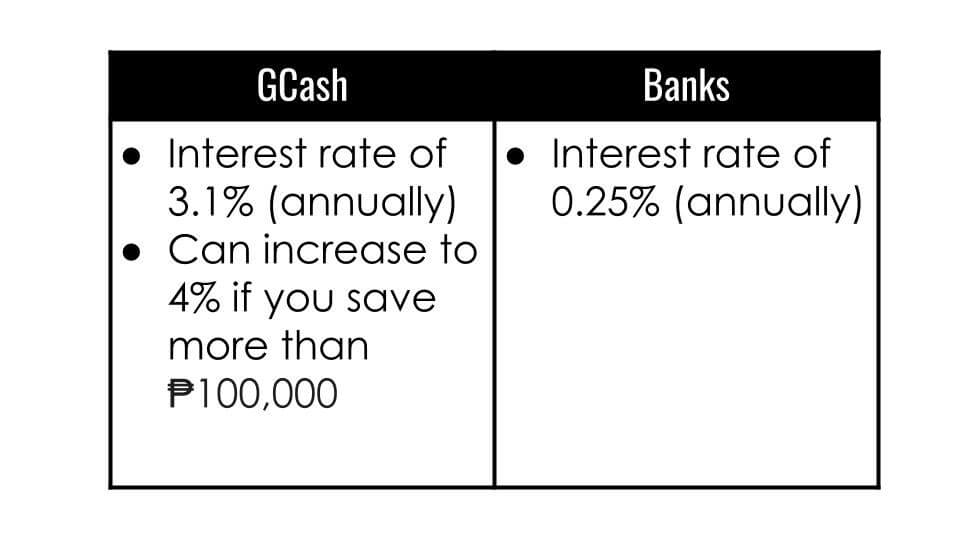

First of all, it has an interest rate of 3.1% per year, which is higher than what banks typically offer. There is even an ongoing promo that if you save more than ₱100,000, the interest rate will increase to 4%. UPDATE: The base rate of GSave is down to 2.6 percent starting March 2021.

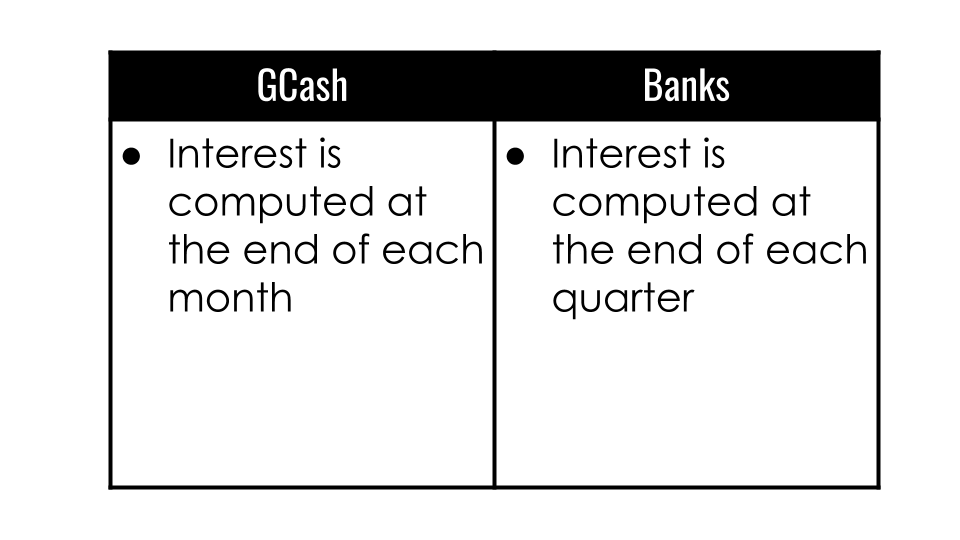

Next, the interest is computed at the end of every month in contrast to banks that compute it only at the end of the quarter. The interest is calculated based on average daily balance which basically means that the longer the money is saved, the higher interest payout you get.

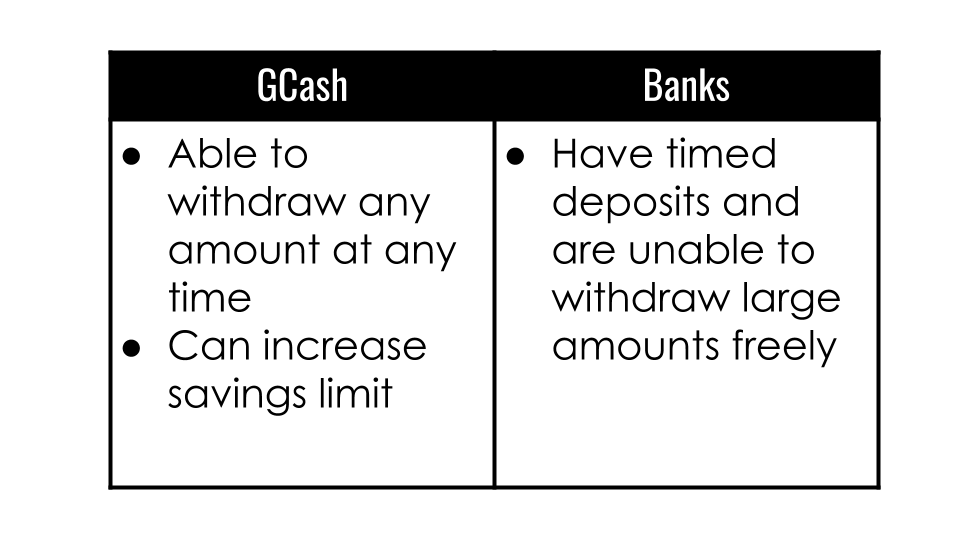

Also, with GSave, you can withdraw any amount at any time. In contrast, banks have timed deposits that restrict customers from withdrawing large amounts freely. You should link your GSave account to CIMB so that you’ll remove the limit of 1 yr validity of GSave.

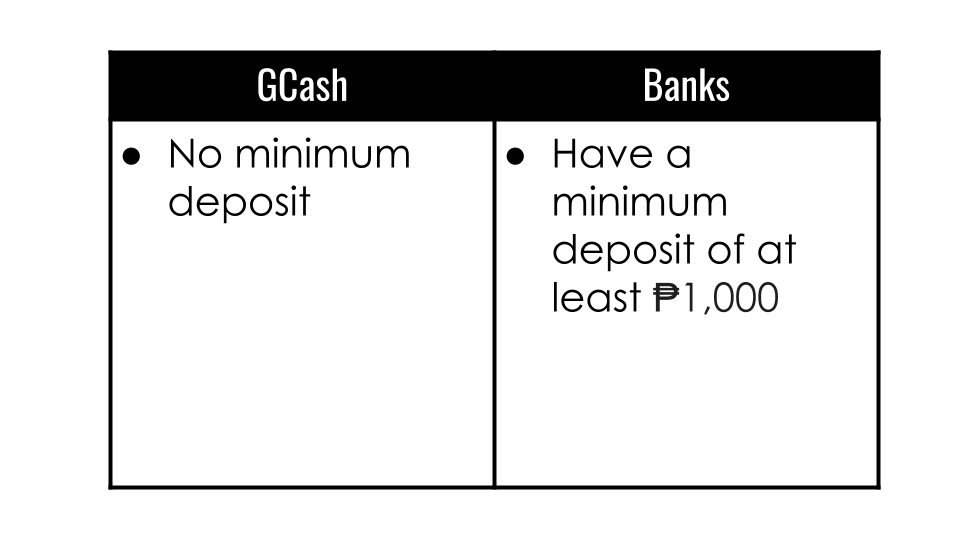

Finally, there is no minimum amount for deposit in GSave while banks usually have a minimum deposit of ₱1,000. With GSave, you can save as much or as little as you want. You should link to CIMB to remove the limit of 100k cumulative deposit.

Upsave and Fast account

If you linked your GSave to CIMB, you can also open Upsave and Fast account. Gsave and Upsave is almost the same. Gsave is 3.1 percent interest per year, while upsave is 3 percent. They both have a promo of free insurance coverage and 4% interest if the average daily balance is at least 100k. While Fast Account is linked to an ATM card where you can withdraw in PesoNet banks without charge and you can apply for it for free. You can just transfer from GSave to Upsave/Fast account.

In conclusion, GSave allows users to be able to save their money with comparably higher interest rates, compounded more often, and the luxury of depositing or withdrawing as much or as little as they want! All of this with the convenience and safety of online transactions.

Another option to check out is Tonik, as it offers higher interest rates up to 4.5 percent per annum, which is very liquid similar to GSave. It also has up to 6 percent interest rate per annum for Time Deposit. You can check other digital banks here.

With all the aforementioned reasons, I highly recommend trying GSave out when saving money instead of opening savings accounts in banks. Even with all the issues of GCash as of late, my overall personal experience has been good and that’s why I’m recommending it to all of you. If you are still unsure, you can start by just trying to save a small amount. You’ll be amazed by how much more you’d have accumulated at the end of the month.

Feel free to share this post with your friends and family so that we can all stop waiting for tomorrow because today is the day that we save up for our future. If you have any questions on this, or any financial questions in general, you may just message me and ask. You can also join my FB group for additional learnings.

Money is a guarantee that we may have what we want in the future. Though we need nothing at the moment, it insures the possibility of satisfying a new desire when it arises.

Aristotle