UPDATE: ING has decided to exit the retail banking market in the Philippines, some services are only available until August 31, 2022.

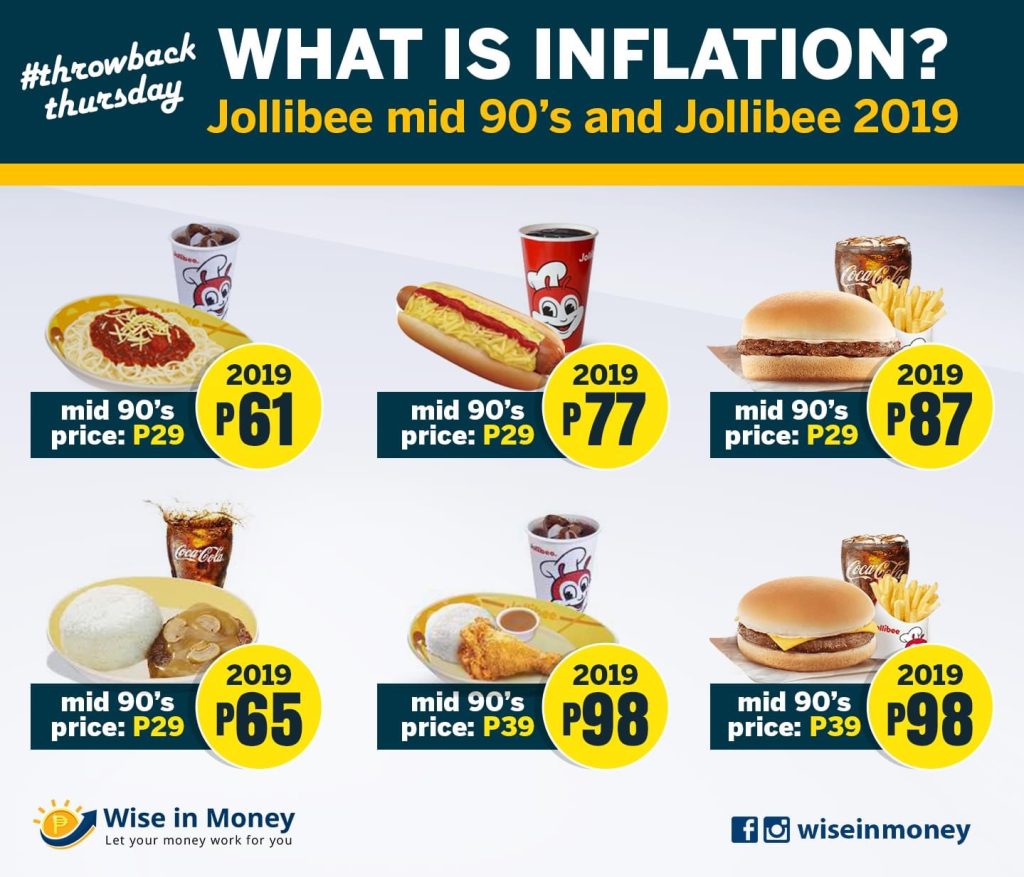

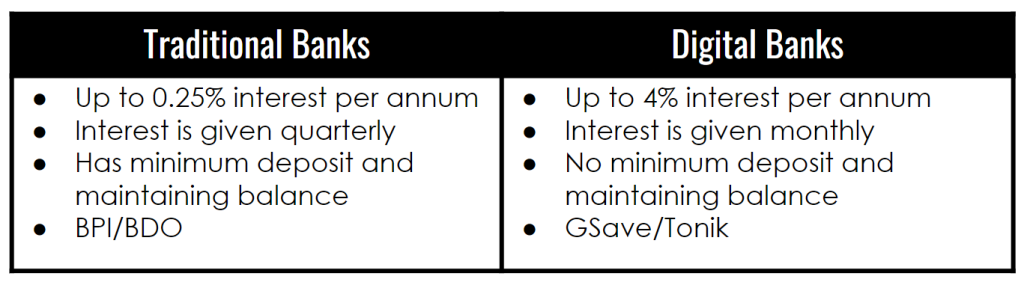

Where do people usually store their money? Some want them in hard cash, but most of us prefer saving in banks such as BPI, BDO, UnionBank etc. Saving in these banks are good, but its interest rate has really went down throughout the years. In the past, you could get 1% per annum, but now it’s way less than that (0.25%). It’s not even enough to beat inflation, the increase in the prices of goods and services in a given economy over a period of time. See picture below for example. The average inflation rate in the Philippines is at 4% per year, which means we shouldn’t just save all our money in the bank.

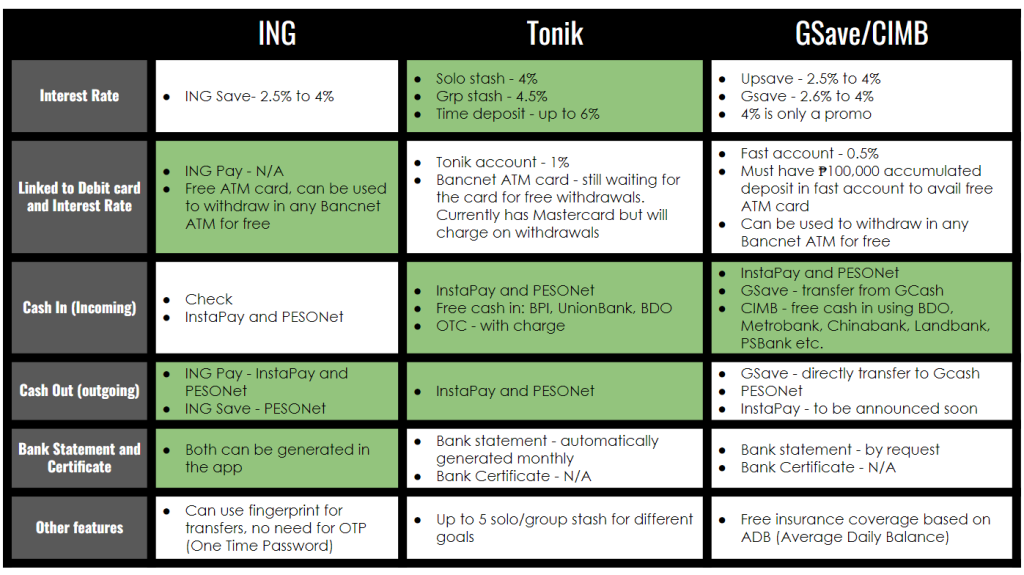

Enter Digital banks such as GSave/CIMB and Tonik. They are better than traditional banks as they offer higher interest rates which is given monthly, with no minimum deposit and maintaining balance. But keeping cash in traditional banks is still a good option for storing emergency funds as we need it to be liquid especially for the inevitable instances that digital banks are down.

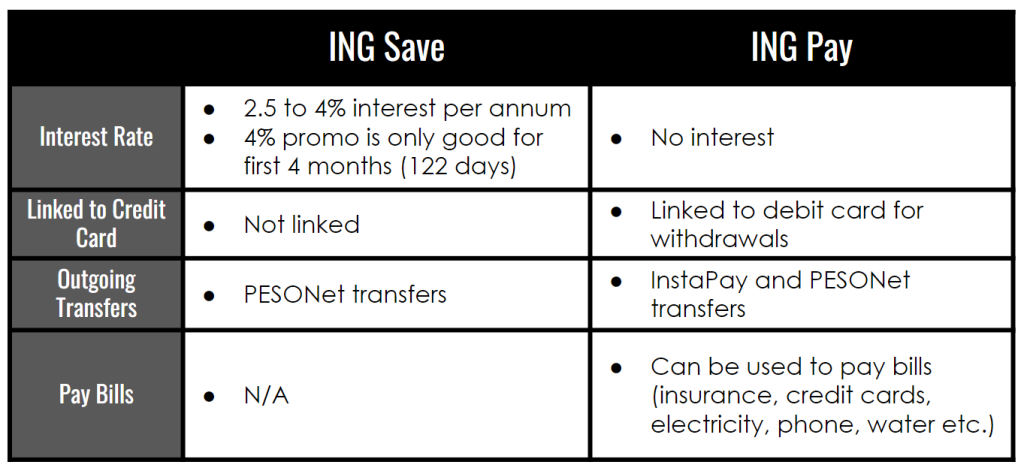

Aside from CIMB and Tonik, another option for digital banks is ING. There are 2 types of accounts in ING: Pay and Save, I recommend opening both accounts as they complement each other. You can transfer from one to the other at real time for free based on your use case below.

ING Save vs ING Pay

*ING Save currently has a 4% promo

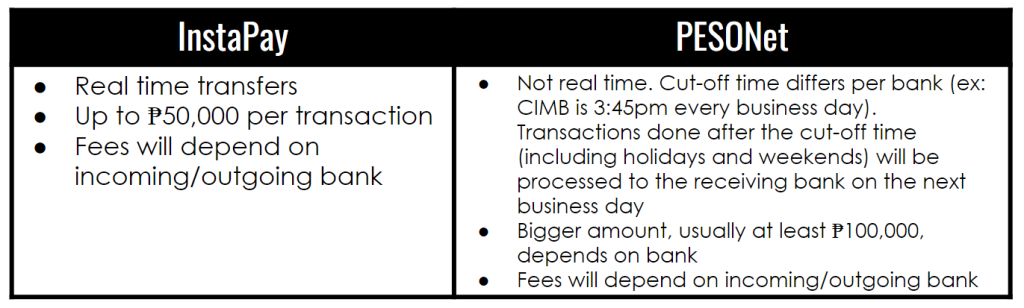

InstaPay vs PESONet

How to get started?

You can reach out to my personal FB account or FB page through the chat below as there’s a promo where we can both get 500 pesos. Just download the ING app in Playstore or Appstore and do the normal KYC (Know Your Customer) process by providing your details and a valid government ID. It usually takes up to 7 banking days to get verified. If you have any questions or concerns regarding ING, you can chat with their support in the app.

Once verified, you can open either an ING Pay or ING Save account or both. You can cash in to your ING Pay or ING Save account by scanning any check. Just follow the instructions in the app. You can also cash in through InstaPay or PESONet. Your ING account number is the 12-digit number on the top-left corner of your dashboard.

For ING Save, you get a 2.5% interest per annum with the interest credited every month. Note that there’s still 20% withholding tax for the interest. There’s a 4% promo for the first 4 months (122 days) of the opening of the account.

There’s also a virtual debit card for your ING Pay that you can use to shop online. You can then request for your free ATM card with card holder in the app. You can use this, along with CIMB ATM card to withdraw from any ATM for free. Note that when withdrawing, it will say that there’s a charge but worry not as this will not be deducted in your account.I haven’t gotten my Tonik ATM card yet as there are charges on withdrawals, but some people mentioned that their withdrawals recently are free, will update this once I get mine.

You can transfer from ING Pay to ING Save and vice versa. You can transfer to other banks through InstaPay or PESONet for free as well. Just input their account number and account name. You can add the recipients as contacts so that you don’t need to put their details again for succeeding transfers.

All in all there’s no one size fits all when it comes to what’s the best digital bank. There is only the best digital bank for you based on your needs and priorities. For me personally, I have all 3 as they each have their own pros and cons. Having multiple digital banks is also a form of diversification as if one is down, I have a backup in case of an emergency.

But if I had to choose one, I’ll choose Tonik as it offers the highest interest rate for stash and time deposit. I can cash in for free through BPI and I can transfer to any bank for free through InstaPay.

If you have any questions or concerns, feel free to reach out here. Do join the Financial Literacy PH FB group for more learnings. You can join the Digital Banks FB group as well.