It’s certainly been a roller coaster ride since my last blog on my journey to becoming a financial advisor.

Over the past year, my network has grown exponentially, especially with the Financial Literacy PH (FinLit) FB group that I created out of nowhere. I consider it as my biggest achievement so far in my life. As of writing, there’s already 60,000 members in just 13 months!

What’s great is that we’ve had many webinars with renowned personalities in the financial industry like Salve Duplito, Sean Si, etc. My younger self would’ve never believed that I would get the opportunity to talk with my idols and pick their brains, while learning from their experience and expertise. We’re planning to improve FinLit this 2022 so we can give more value, so just stay tuned for that!

I may not have gotten that many awards as a financial advisor since it focuses more on sales, but I had numerous speaking engagements because of FinLit, from different universities to even my previous company, Accenture. After leaving, I transferred to a different IT company as the pay is better, which is something that I really considered since we aren’t getting any younger especially after 2 years in this pandemic.

My lowest point of the year would be my mommy’s passing last July 30. Who knew that out of my many clients, I’d be the one to have a first hand experience of losing a loved one. Since Mommy’s insurance was from a different insurance company and her FA passed away earlier than her, I had to file a claim online and thankfully the claim was already processed. Insurance really works! That’s why I have to make sure to be with my clients’ family and beneficiaries when the time comes to help them with the claims.

Tips and Tricks

Let me share to you some tips and tricks to current and future financial advisors that I’ve learned so far to be successful in the industry:

- Always give value – As a financial advisor, our duty is to educate Filipinos on financial literacy, not to sell them insurance. If we are able to present insurance to our prospects and they choose not to avail, at least we’ve still added value to them. They’ll remember you once they’re ready to start insurance. Remember to have a giving mindset rather than to have a receiving mindset.

- Invest in yourself – Even though the main product that we offer is insurance, you shouldn’t limit yourself to knowing just that. We should be all around and be up to date with all facets of personal finance such as savings, budgeting and investments. As lifetime partners to our clients, we should be able to guide them from getting started up until they retire.

- Maximize social media – Everything is online right now and you’re missing out if you don’t have a good social media presence. Don’t be a secret agent, there is no need to be ashamed that you’re a financial advisor as it’s a very noble job.

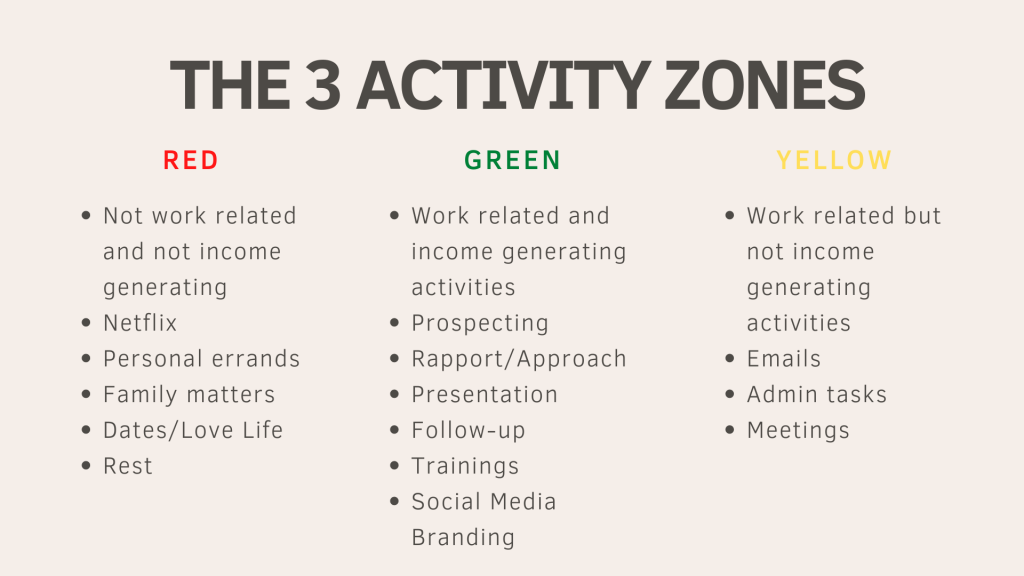

- Activities! – There’s no secret formula to success in this field. Maximize greenzone activities such as prospecting, setting appointments, and following up. We should lessen yellow (admin work, meetings) and red zone activities that are not income generating.

- Be immune to rejections – You’ll be eating rejections/objections for breakfast, lunch and dinner. From inboxzoned, seenzoned to even blocked! Sales is not for the faint hearted. Just move on to the next prospect, remember there are millions of people in the world.

- Time management – We all have 24 hours in a day. A majority of FAs are part time, including myself, so we really have to manage our time wisely and prioritize. I still need to improve on this as I have my own personal and business goals.

- Focus on your strengths and manage your weaknesses – We all have different backgrounds, so don’t compare yourself with others. What might work for me, might not work for you and vice versa. Instead, look to improve everyday.

- Know your biggest why – There’s a season for everything. There will be lots of times that you’re not feeling it and you’ve dealt with rejection after rejection even when you put all your effort into something. It’s your why that will push you to move forward. For me, my biggest why is to educate Filipinos in Financial Literacy as it’s not taught yet in schools, thus I’ve created the FB group and look how far I’ve come now.

Hopefully you’ve picked up a few things. If you read this and think that you’re interested and inspired in becoming a financial advisor, feel free to reach out. I’ll be glad to help you get started by sharing my experiences and practices as I also plan on being a full time financial advisor in the future and building my own team.

It is more blessed to give than to receive.

Acts 20:35