Disclaimer: All the opinions written in this post are my personal opinions. I am neither affiliated in any way with GoTrade nor do these opinions reflect any of GoTrade’s opinions.

Saving and investing have now been very convenient and accessible as everything is now online. With GInvest of GCash, you can invest in local funds for as low as ₱50 and global funds for as low as ₱1000. What’s great is that you can also invest in US companies like Apple, Google, Microsoft & Facebook for as low as $1 through GoTrade.

GoTrade allows people outside the US to buy US Stocks and ETFs (Exchange Traded Funds). GoTrade partnered with Alpaca Securities LLC. It’s registered in the US and they’re responsible for the clearing and executions of the trades. You can read more here.

if you’re not yet familiar with how the stock market works, you can read my blog. An Exchange Traded Fund (ETF) is a basket of securities that is traded on a stock exchange just like a stock does. An example is S&P 500 ETF (VOO) which I personally invest in as it tracks the 500 large companies listed on stock exchanges in the United States, so it’s broadly diversified and the returns are really good in the long term. You can watch this for more details.

You can explore what stock/ETF to buy by exploring the different categories. There’s even one for Warren Buffett for example, so you’ll know where one of the most successful investors in the world invests in. Buffett also recommends investing in S&P 500 for the long term

Buying/Selling

There are 3 options when buying a stock/ETF. Selling is just the same, you just need to have the stock/ETF before selling.

- Buy in dollars – the most common way where you’ll just input the number of dollars to buy. Minimum is $1

- Buy in shares – you can even buy fractional shares as stocks and ETFs cost hundreds or even thousands of dollars.

- Buy at limit price – you’ll set the price before the buy order is executed. Minimum is 1 share

Market hours are open Monday to Friday from 9:30 AM to 4 PM Eastern time (9:30 PM to 4 AM Philippine time) when the orders will be executed. The hours will move by an hour later (10:30 PM to 5 AM Philippine time) due to Daylight Savings Time (DST) from November to March.You can easily see if the market is open on your GoTrade home screen.

The investing strategy is just the same as GInvest and stocks where you should cost average, meaning you should consistently invest a certain amount for a specific period of time, so there’s no need to time the market. Time in the market is better than timing the market. For me, I invest $100 (~₱5000) per month on GoTrade, along with my other investments when I get my salary.

Although it might be called GoTrade, but it’s not for trading. There’s a limit for day trading to 3 transactions for 5 business days if your balance is less than $25,000.

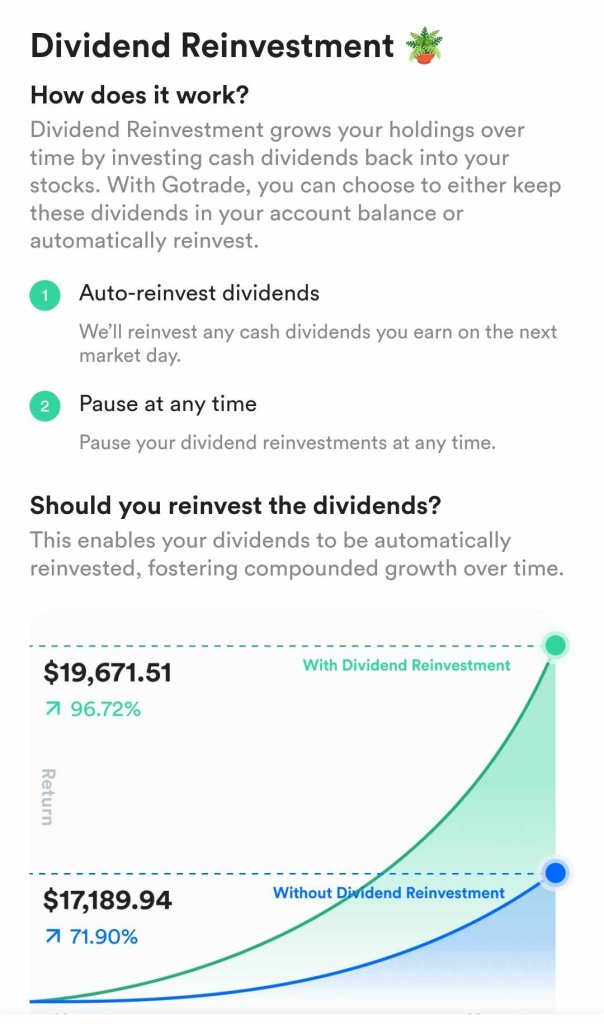

You’ll also be able to receive dividends from some stocks and ETFs but the dividend rate is lower than in the PH. The dividend tax is bigger in GoTrade (25%) when compared to the Philippines (10%). If the dividend you are due to receive is less than US$0.01, you will not receive anything. Dividends will go to your Cash on your home screen once they’re given out, so the best practice is to reinvest them to maximize the power of compounding. UPDATE: There’s a new feature for dividend reinvestment where it will auto-reinvest the dividends for you. I’ve already enabled this feature in my VOO.

How to start

You download the GoTrade app through the App Store or Play Store. You can get up to $6 worth of free credits when you sign up, doing a $10 deposit and buying your first stock.

You can use your passport, driver’s license, voter’s ID, NBI clearance, or postal ID to be fully verified. if you’re having issues, you can chat with the support under “Funding instructions & help” .

I don’t recommend using GCash as the fee is 3%. The recommended way of cashing in is through BPI and Unionbank, where you can open your first account of either online. You just need to be at least 18 yrs old and have a valid government ID. Note that there’s an initial deposit needed and a maintaining average daily balance to not incur charges.

You can deposit via UnionBank or BPI with a minimum of $10. There’s a ₱10 bank charge for UnionBank and ₱12 for BPI. Since it is in dollars, this will be based on the conversion rate. Note that there is a premium on the exchange rate for the instant deposit compared to the normal deposit. So I suggest using the normal deposit if you’re not in a rush, which will take at most 24 hours. UPDATE: trading fee is 0.25% per trade, you can check the updated fees inside the app.

I haven’t tried withdrawing but withdrawal costs $12 so I recommend only withdrawing once in a while so you can maximize your returns. This shouldn’t be a problem if you’re a long term investor. UPDATE: Withdrawal now only costs $5.

Another option in investing in US stocks is through Etoro but the minimum investment to start is $200. You can have a feel with the Etoro platform without deploying capital by using Virtual Portfolio. UPDATE: Minimum investment is now $50.

Final thoughts

Remember to always practice due diligence before deploying your hard earned money on any investments. Do not just blindly copy what stocks or ETF I or your friends use. What might work for me, might not work for you.

What’s important is that you study on your own so that you’ll have conviction on your decision. You won’t have anybody to blame if something goes wrong aside from yourself. So I suggest trying with a small amount and learn as you go.

Once you successfully sign up, you can also invite your friends to use GoTrade. Note that the invite codes are only for one time use. UPDATE: GoTrade removed referral bonus.

You can check the GoTrade FAQ here. You can also join the GoTrade FB grp and Discord. Do join the Financial Literacy FB group that I created for additional learnings. Lastly, feel free to check Enery Finance Drive FB Page as I’m more active there compared to my once a month blogs.