With the pandemic, people tend to understand more the concept and importance of insurance. But with that, there are more and more financial advisors offering more and more products on the market. This can be overwhelming, especially for newbies or people just starting out. So I’ve created the FAQs for insurance and what questions to ask to a Financial Advisor (FA) so that you have a better idea of what to do during that appointment.

Things to ask your FA during an appointment

- Ask for the FA’s experience and awards if they have any. Credibility is super important as you’re trusting your hard earned money in a lifetime commitment.

- A good FA must be able to share the ins and outs of the product. If an FA only shares the good side of the product and doesn’t share the downsides/cons, then that’s not a good sign.

- Mission over commission. Insurance might be sales, but it’s really all about helping others. You’ll just know during your discussion if the FA has genuine concern for you, or if they’re just trying to squeeze more money out of you.

- What are the other services that I can expect from you? A true financial advisor should not only be able to cater your insurance needs, but should also be able to help you from end to end processes such as saving, budgeting, insurance, investments etc.

- What will happen if the FA resigns or passes away first before the client? The normal process is that the FA’s teammate or manager should shoulder all that FA’s clients. If that happens and you know someone from a same company that you want to be your FA, you can ask him/her to transfer your policy to your acquaintance.

- In my case, my mom passed away last July 2021. Her insurance was from a different insurance company and her FA passed away earlier than her. I had to file a claim online and thankfully the claim was processed quickly.

Frequently Asked Questions

What is the best insurance company?

- As long as it’s in the top 10 such as Sun Life, Pru Life, Manulife, AXA, AIA etc. you can’t really go wrong. Instead focus more on the FA as this will be a lifetime commitment. You can also consider having an appointment with different companies so that you’ll know all your options. Remember that simply talking with an FA in no means requires you to avail insurance with them.

What’s the best insurance for me?

- As mentioned in my previous blogs, there’s no one size fits all when it comes to insurance as we all have different circumstances, capacity, dependents etc. That’s why it’s necessary to have a Financial Needs Analysis (FNA) with an FA so that they can ask the right questions before offering a solution. If an FA just offers you a product without asking questions, then that’s a red flag which probably means that they’re just after the commission.

Differences of Traditional vs VUL Insurance

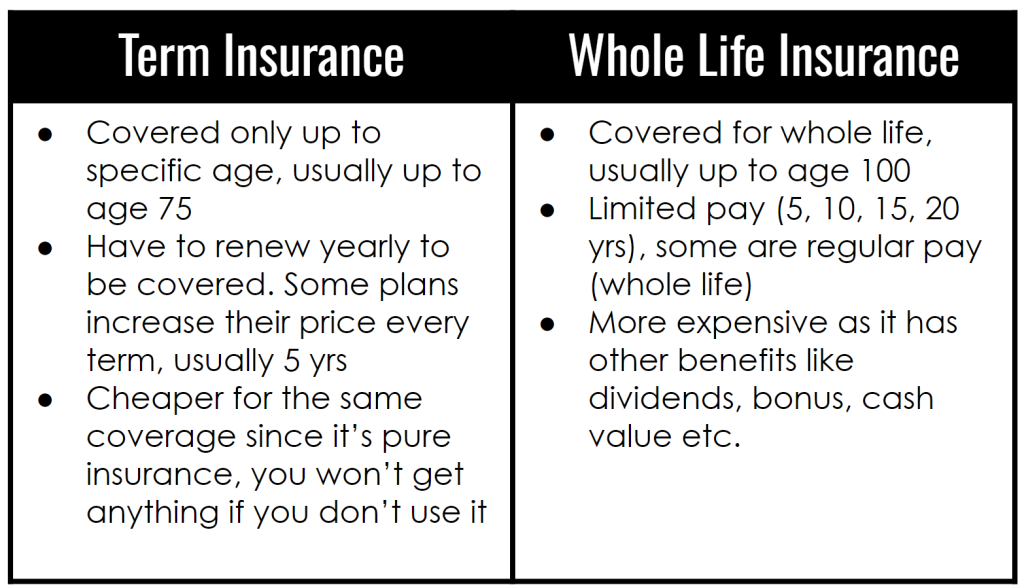

Difference of Term and Whole Life Insurance

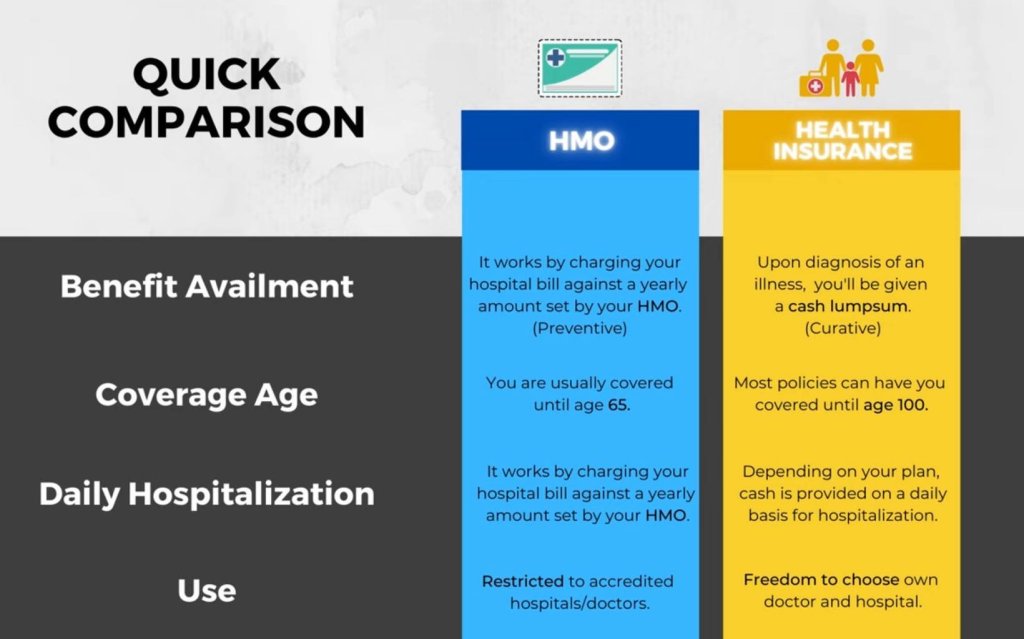

Difference of Health Insurance and HMO

- Health Insurance can be called Critical Illness Insurance as you can get a lumpsum amount if in case you get diagnosed of critical illness. While HMO (Health Maintenance Organization) is more for inpatient, outpatient, checkups etc. Usually companies offer HMO as an employee benefit. They complement each other so it’s better if you have both. You can message me if you want me to refer you to an HMO Agent (ex: Maxicare, Medicard etc.)

How long is the payment for insurance?

- It depends on the plan, there are plans that are limited pay only (ex: 5, 10, 15, 20 years), while there are plans that are paid for a lifetime (ex: up to age 100). For traditional plans, the payments are like loans that will be cheaper in the long run for less years of payment.

- For example a 10 year payment will be more expensive than a 15 year payment plan. Example: ₱50,000/year x 10 years = ₱500,000 vs ₱36,000/year x 15 years = ₱540.000.

Different types of VUL

How long am I covered? What happens if I reach over the age covered?

- What’s great about insurance is that even if you just have the initial payment, even if it’s just a quarter, you’re guaranteed for the whole insurance coverage. For example, a ₱3,000 quarter payment can become ₱1,000,000! That’s the power of insurance.

- There’s a 2 year contestability period for life insurance. If you pass away in the first two years of your life insurance coverage, the insurance company has a right to contest or question your claim. This means that the insurance company may investigate the details of your medical history to make sure you didn’t misrepresent information on your application. If you did misrepresent or the cause of death is invalid such as suicide etc, the family/beneficiary will only get a full refund of the premium paid instead of the insurance coverage listed in the plan.

- For critical illness, there’s a waiting period as well which differs from company to company. For Sun Life, it’s 90 days after the approved/settled date.

- It depends on the plan for how long you are covered. If you outlive your plan, you’re not covered anymore. For VULs, if you outlive your plan, usually the fund value/investment will be given to you. While for traditional plans such as participating plans, the dividends and other bonuses are given to you.

What are the charges for VUL?

- Many FAs don’t explain this and the clients will just be shocked that their fund value is smaller than their contributions. Since VUL is insurance with investment, not the full 100% goes to investment, which is why you need to know these numbers. This includes insurance charges, maintenance, commission etc.

- Charges occur monthly, which would mean a deduction in the fund value. This should be visible in the app/website of your insurance company.

For VULs, when is the right time to withdraw?

- Remember that VULs are considered as insurance with an investment component, not the other way around. So the main focus/goal of availing of VUL is still the protection/insurance, as the investment part is never guaranteed. Thus it is called “Variable” Universal Life insurance. VULs are designed to be long term as a big portion of the premium paid by the client will go to insurance charges for the first few years.

- There’s always a debate if VUL is a scam, so I suggest reading my blog on BTID vs VUL so you’ll know your options.

What is the withdrawal process of VUL?

For simplicity purposes I’ll use regular/limited pay VUL as it’s more common than single pay VUL.

- Full withdrawal – remember that your payment in VUL might be limited but the charges are lifetime. Example: for 10 years payment VUL, on the 11th year since you don’t pay anymore, the charges will come from the fund value. Since your fund value is 0, you would need to pay the yearly charges if you still want to be covered. This is not recommended as this will make your payment lifetime as well.

- This should only be done if you’re canceling your plan, just remember that you won’t get the full amount you’ve paid as a portion already went to insurance charges. Make sure to have replacement insurance if you’re going to cancel so that you can have the peace of mind if something bad happens.

- Partial withdrawal – this is better because as long as you have enough fund value to cover your charges, you’re still covered/insured. Just leave a buffer to make sure it has enough to cover the charges for the next few years. You can ask your FA about this. This can be directly credited to your bank account.

What is the claiming process?

- Assuming something bad happens (sickness, accident, death, disability) to the policy owner, the family/beneficiaries should inform the FA and the FA should help with the claiming process. You should provide the necessary requirements such as a death/medical certificate etc. Then when everything is all good and the insurance is already approved, the FA should give the check to the family/beneficiaries through a check. But a direct bank transfer is also an option.

How many insurance plans should I have?

- Insurance is not a one time thing. It depends on your goals and dreams. In each stage of our lives, our priorities would be different.

- Make sure to do the math. The rule of thumb of life insurance coverage is 10 times your annual salary. While critical illness insurance coverage should be 5 times your annual salary. You don’t need to get that huge coverage at the start. You can start by getting a small one and then add more once you have better cash flow.

- If you already have VUL, you might consider availing health insurance as it’s for a different purpose or vice versa.

I already have insurance as an employee, should I still get personal insurance?

- Yes, as it’s an employee benefit, you won’t be covered anymore if you either resign or stop being a part of the company. Also, it’s good to have an FA that will guide you every step of the way.

Is it possible for top up to have higher insurance coverage?

- Top up is not allowed as age is a major factor when it comes to how much the contribution for the insurance is. For example, you got a ₱1,000,000 insurance coverage at age 25, then you want another ₱1,000,000 at age 30, you should get a new plan if you want additional coverage.

- Top up is only allowed for the fund value in VUL. This means that the insurance coverage is guaranteed while the fund value is not.

What’s the process of availing insurance?

- Since we’re in a pandemic, everything is accessible online. You just need to fill up forms and answer questions regarding your insurability, medical history etc. Aside from that, you’ll need a valid government ID and the initial payment depending on your chosen plan. Payment is also done online through credit cards, bank transfers, bills payment, Gcash/Paymaya etc.

Can I avail of insurance even if I’m abroad?

- Both the client and the FA need to be on Philippine soil to sign up for insurance even if everything is online. If either is abroad, the contract will be considered null and void, which means you won’t be able to claim it when the time comes. Do let your friends/family know if you know somebody’s practicing this.

Can I only avail of insurance through an FA?

- There are micro insurance such as GInsure (Gcash) and Kwik Insure, you just register/avail of insurance online or through the app.

- It is really affordable and perfect for people on a tight budget, but it shouldn’t replace personal insurance.

- For claiming, you’ll claim online or through the app as there’s no FA.

Is there insurance for my whole family?

- Usually, insurance is per individual so you’d have to get one for each family member. You can avail of insurance for a family member where you’re the policy owner and your parent/child is the life insured. This will just have additional requirements. Make sure both owner and insured are residing in the Philippines as mentioned in the previous step.

- GInsure offers insurance for the family (Cash for Medical Costs) where you can insure yourself, your spouse and your children.

- Group life insurance is for employees, not for families, which means it’s a very small premium for a small coverage.

Now, I hope that you know a thing or two when it comes to insurance. If you’re interested in availing insurance or have any questions, feel free to reach out here. Do join the Financial Literacy PH FB group for more learnings. We’re a community that has steadily grown to over 80,000 members in just 15 months. Also, you can read my journey if you’re interested in becoming an FA yourself.